|

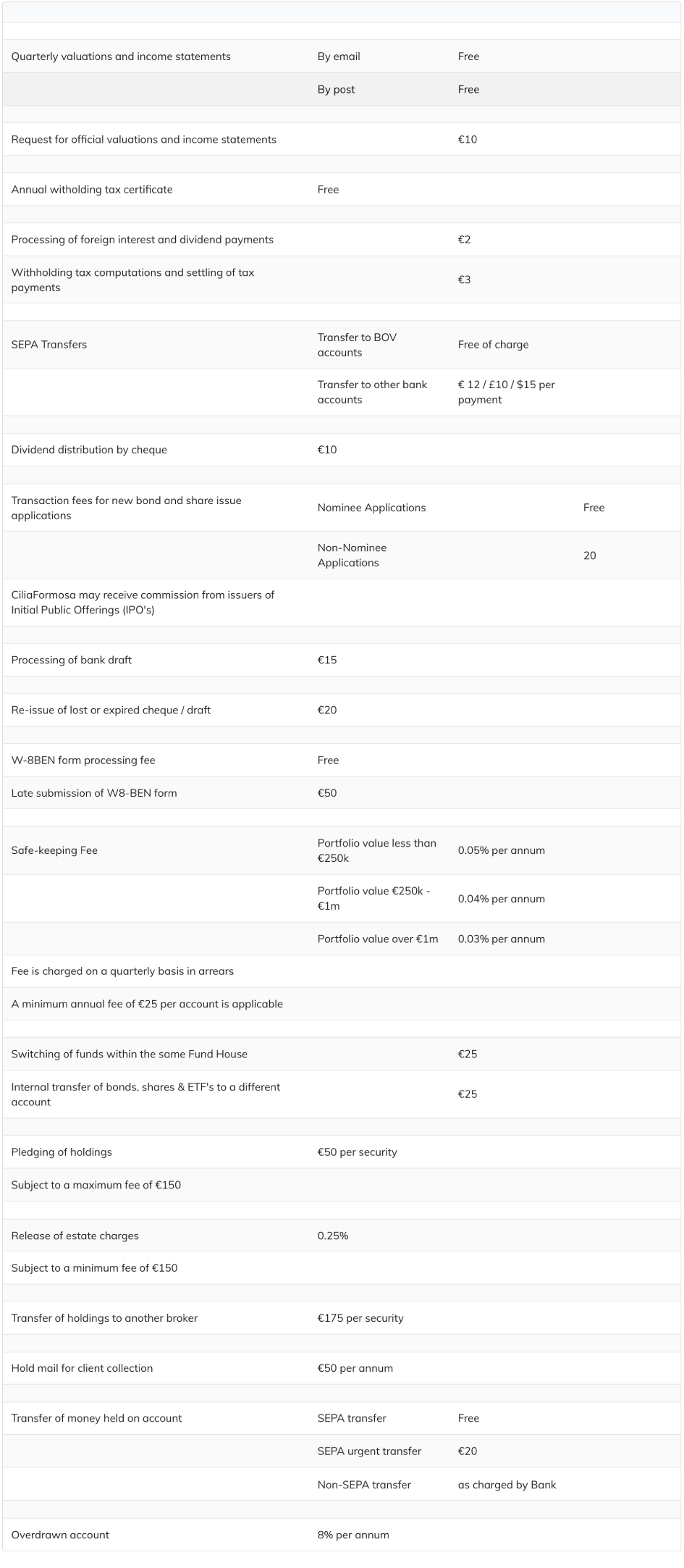

Quarterly valuations and income statements |

By email |

Free |

|

|

By post |

Free |

|

Annual witholding tax certificate |

Free |

|

Processing of foreign interest and dividend payments |

€2.50 |

|

Withholding tax computations and settling of tax payments |

€3 |

|

Transfer of Dividends |

Transfer to any bank account - as charged by Bank |

|

Dividend distribution by cheque |

€10 per cheque |

|

|

Transaction fees for new bond and share issue applications |

Nominee Applications |

Free |

|

|

Non-Nominee Applications |

€20 |

|

CiliaFormosa may receive commission from issuers of Initial Public Offerings (IPO's) |

|

Re-issue of lost or expired cheque |

€20 |

|

W-8BEN form processing fee |

Free |

|

Late submission of W8-BEN form |

€50 |

|

Safe-keeping Fee |

Portfolio value less than €250k |

0.05% per annum |

|

|

Portfolio value €250k - €1m |

0.04% per annum |

|

|

Portfolio value over €1m |

0.03% per annum |

|

Fee is charged on a quarterly basis in arrears - A minimum fee of €25 per account is applicable |

|

Internal transfer of holdings |

€25 |

|

|

Investment Confirmation Letter |

€75 |

|

|

Pledging of holdings |

€50 per security |

|

Subject to a maximum fee of €200 |

|

Onboarding fee - clients with third country connections* |

A minimum of €2,500 |

|

*Potential clients having relevant personal links to third countries and/or high risk jurisdictions (based on Customer Risk Assessment) |

|

Annual due diligence fee for clients with third country connections* |

€750 per annum, paid quarterly in advance |

|

|

Disbursement of Compliance and Regulatory Fees* |

€1,050 per annum, paid quarterly in advance |

|

|

*Potential clients having relevant personal links to third countries and/or high risk jurisdictions (based on Customer Risk Assessment) |

|

Release of estate charges |

0.25% |

|

|

Subject to a minimum fee of €150 |

|

Early account closure Fee |

Within 12 months of opening |

€500 |

|

|

Between 12 and 24 months of opening |

€250 |

|

Transfer of holdings to another broker |

€175 per security |

|

|

Hold mail for client collection |

€50 per annum |

|

|

Transfer of money held on account |

SEPA transfer |

as charged by bank |

|

|

SEPA urgent transfer |

€20 |

|

|

Non-SEPA transfer |

€50 |

|

Overdrawn account |

8% per annum |

|